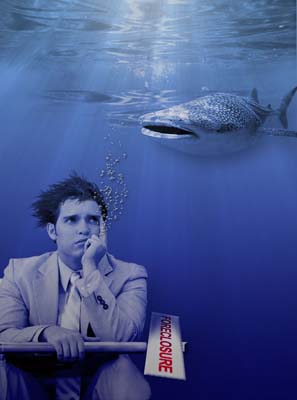

With more homes falling to foreclosures, many formerly-owned homes are now finding themselves occupied by renters.

With more homes falling to foreclosures, many formerly-owned homes are now finding themselves occupied by renters.

The shift from owner-occupied homes to renter-occupied homes has no end in sight due to the ever lasting housing-market collapse and recession that is currently plaguing the United States. Nationwide, 34.9% of occupied homes – including houses, condos, and apartments – were rented in 2010, up from 33.8% in 200.

Florida, a state that has been hit relatively hard by foreclosures, has seen a 5% growth in renter-occupied housing. Prior to 2006, the renter-household market was “fairly stable,” but since 2006, the U.S. has seen an increase of about 692,000 house rentals a year. This figure is astronomical when comparing it to the number of owner households, which is falling at an average of 210,000 a year.

Several factors will boost rental growth for years to come, including continued forecloses, continued drops in home prices that frighten buyers and potential cuts to government subsidies supporting home ownership. Despite a large percentage of renters favoring home ownership over renting, renters will have to contend with the current status quo until the housing market recovers.

A main culprit behind the housing market’s continued struggles, aside from the real estate market’s collapse, involves all of the recent scandals that have plagued our real estate market.

For instance, allegations of robo signing, fraud, documentation errors, issues with process servers, problems servicing loan modifications, and other similar issues, have prompted many lenders to slow down the foreclosure process which in turn has slowed down the housing recovery.

Consider Your Options. Contact Us Today.

We have been successful in defending many foreclosure cases when given an opportunity to develop a plan to properly defend the foreclosure.

Our Miami foreclosure defense lawyers have assisted many homeowners in buying enough time to reach the solution that is right for them. There are many alternatives to foreclosure, and often times it just takes proper planning to properly navigate against the potential pitfalls. Help is often available to those who seek it.

If you are on the brink of foreclosure, need a real estate attorney, or just need to assess your legal rights, please contact our office today.

Call us today toll free at 1-866-518-2913 or at 305-263-7700.

According to recent news reports, nearly half of the mortgages in South Florida are currently underwater. Specifically, 46% of all homes in Miami are currently underwater, while 49.4 % of homes in Ft. Lauderdale are underwater.

According to recent news reports, nearly half of the mortgages in South Florida are currently underwater. Specifically, 46% of all homes in Miami are currently underwater, while 49.4 % of homes in Ft. Lauderdale are underwater.