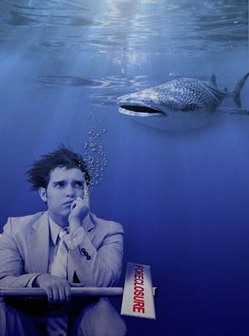

The term “underwater” typically refers to the situation where a borrower owes more on their home than their home is worth. According to news reports, Florida is behind only Nevada and Arizona with the amount of homes with negative equity, or that are currently “underwater.”

The term “underwater” typically refers to the situation where a borrower owes more on their home than their home is worth. According to news reports, Florida is behind only Nevada and Arizona with the amount of homes with negative equity, or that are currently “underwater.”

Nearly half of all Florida homeowners had mortgages that were “underwater.” Specifically, more than 2 million mortgages out of 4.5 million are currently underwater. Additionally, an almost 200,000 more were near negative equity.

The high number of loans that are “underwater” is an increasingly disturbing trend in South Florida. The reason being is that may individuals with a loan that is “underwater” have decided to “strategically default” on their loan.

What is a ‘strategic default’? It is a decision by a borrower to stop making payments on a debt despite having the financial ability to make the payment. The large financial firm, Morgan Stanley, for example, recently made the calculated decision to give up five San Francisco towers it purchased at the peak of the booming real estate market.

Many individual borrowers are also turning to the same strategy used by Morgan Stanley, and others, and are seeking solutions to the problems brought in by the unstable real estate market. And the reason ‘strategic defaults’ are becoming so popular are for a number of different reasons.

For instance, many homeowners are unable to sell their homes without bringing tens of thousands of dollars to the closing table. Consequently, many of these owners just give up and walk away. This, in turn, triggers more foreclosures and, ultimately, price declines.

Today’s current real estate market, and ongoing foreclosure crises, presents all sorts of issues that must be properly navigated. There are many factors contributing to Florida’s nation leading delinquency rates. They include a weak job market, weak economic recovery, and a major drop in home prices. Consequently, Florida’s housing market remains unsettled in large part due to the continued foreclosure crises.

Our Miami foreclosure defense lawyers have assisted many homeowners in buying enough time to reach the solution that is right for them. There are many alternatives to foreclosure, and often times it just takes proper planning to properly navigate against the potential pitfalls. Help is often available to those who seek it.

—–

EXTENDED BODY:

Consider Your Options. Contact Us Today.

We have been successful in defending many foreclosure cases when given an opportunity to develop a plan to properly defend the foreclosure.

If you are on the brink of foreclosure, need a real estate attorney, or just need to assess your legal rights, please contact our office today.

Call us today toll free at 1-866-518-2913 or at 305-263-7700.